By Lisa Sturtevant, PhD

Chief Economist, Bright MLS

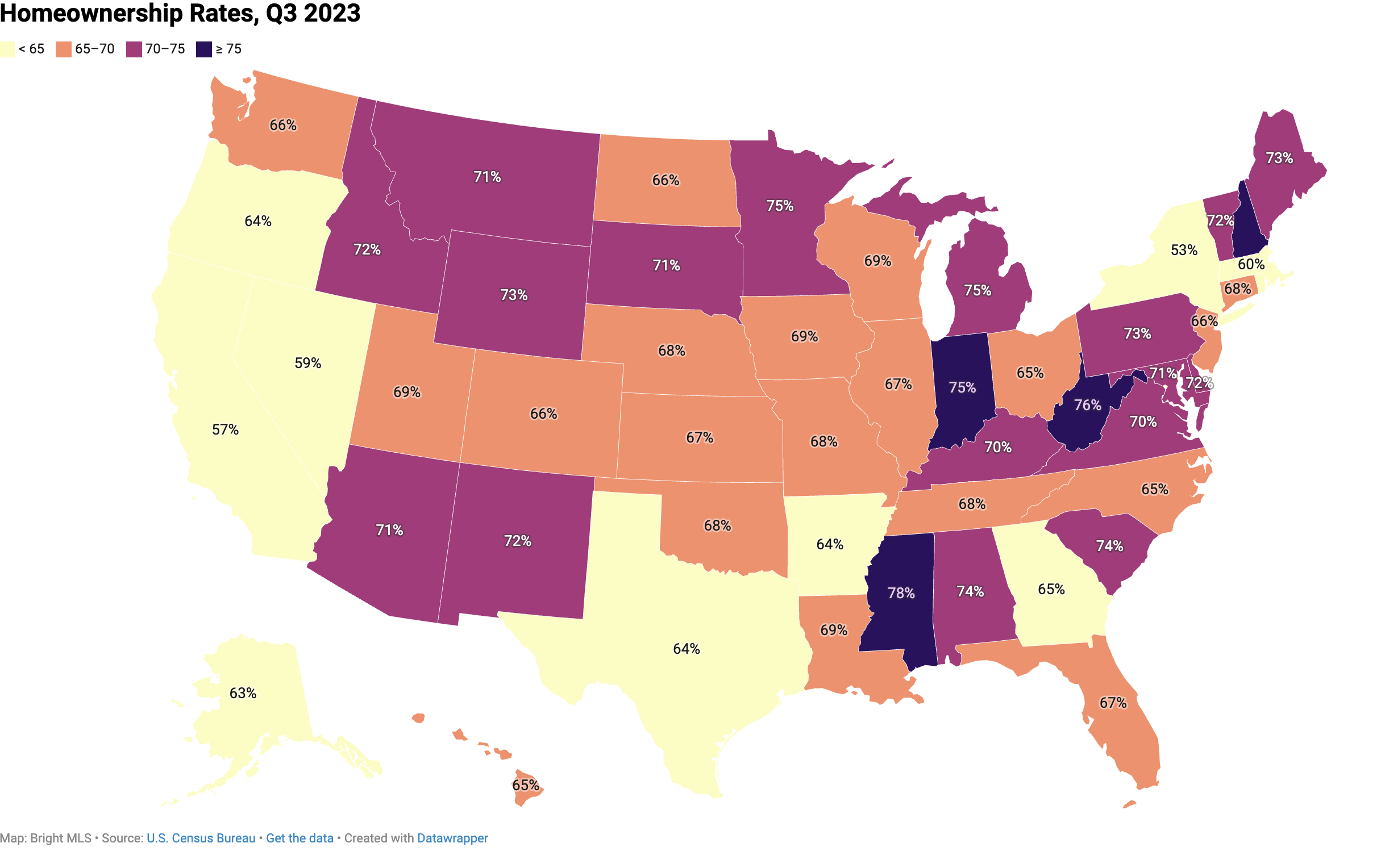

Rural states in the U.S. tend to have the highest homeownership rates. In the third quarter of 2023, Mississippi had the highest state homeownership rate at 78.5%. West Virginia, New Hampshire, Indiana, and Minnesota rounded out the top five.

Homeownership is also more common in states where housing is more affordable. In South Carolina, where the homeownership rate is 74.3%, the median home price was about $360,000 in 2003. By comparison, the homeownership rate was 60.3% in Massachusetts, where the typical home sold for nearly $600,000.

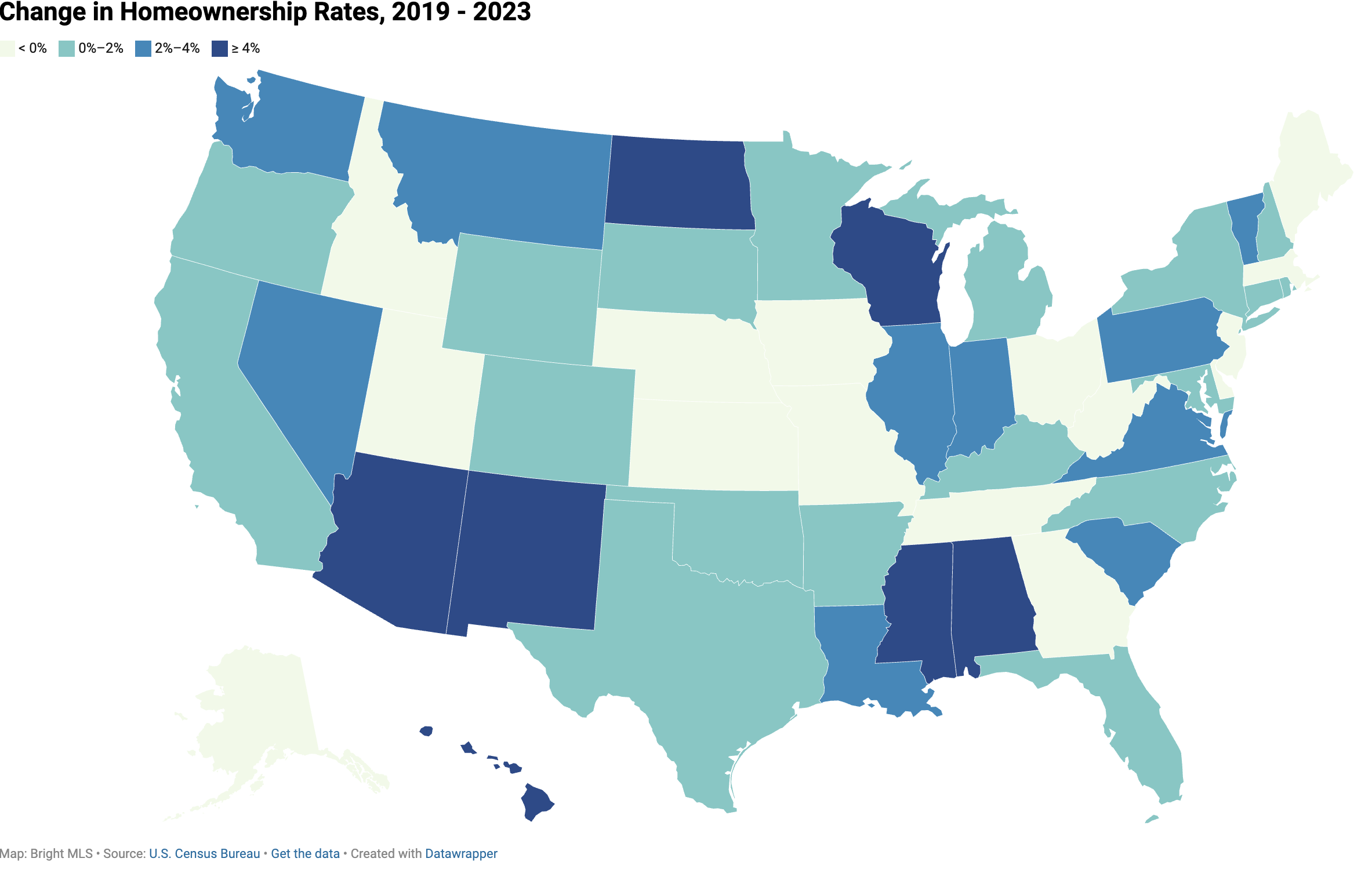

During the pandemic, mortgage rates fell to historic lows, bringing record numbers of homebuyers to the market. The U.S. homeownership rate rose from 64.8% in 2019 to a peak of 67.9% in the second quarter of 2020 before declining to 66.0% in the third quarter of 2023.

Lifestyle choices of movers during the pandemic meant that some states attracted homebuyers much faster than others. Between 2018 and 2023, the homeownership rate in North Dakota increased from 59.9% to 66.3%, a 6.4 percentage point increase and the biggest of any state. Homeownership rates jumped by more than 5 percentage points over that time period in New Mexico and Alabama.

However, 16 states experienced a drop in their homeownership rates between 2019 and 2023, with the biggest declines in Utah (-2.9 percentage points), Missouri (-2.7 pp), Ohio (-2.6 pp), and Nebraska (-2.6 pp). Some of these states have relatively affordable housing, but there has been more outward migration from these colder-climate states over the past few years.

In the post-pandemic housing market, housing affordability and quality of life will continue to be a draw for homebuyers, particularly those who continue to work remotely. As mortgage rates remain elevated in 2024, states with desirable amenities, good weather, and an affordable housing stock will likely see their homeownership rates continue to rise.

.jpg)